Ashford University Official Transcript Request 2015-2025 free printable template

Show details

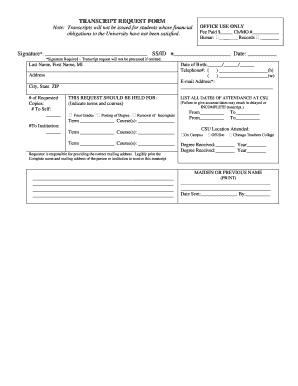

Official Transcript Request Revised 8/11/15 Submission Instructions Online students: Submit this completed form with noncredit card payment to: Ashford University Office of the Registrar, 8620 Spectrum

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ia salaries form

Edit your notification email form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your registrar salaries form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit office request form online

Follow the steps below to use a professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit office request form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out office request form

How to fill out ia salaries?

01

Collect all relevant financial information for each employee, such as their salary, bonuses, and overtime pay.

02

Determine the appropriate tax obligations for each employee based on their income level and tax bracket.

03

Calculate any deductions or withholdings, such as social security contributions or healthcare premiums.

04

Ensure accuracy by double-checking all calculations and entering the data correctly into the payroll system.

05

Generate salary statements or pay stubs for each employee, detailing their earnings, deductions, and net pay.

06

Keep accurate records of all salary-related information for future reference or tax audits.

Who needs ia salaries?

01

Employers: Businesses and organizations use IA salaries to determine and distribute payroll for their employees accurately. They rely on IA salaries to calculate the net pay, deductions, and tax withholdings accurately.

02

Employees: Workers rely on IA salaries to receive their salaries correctly and to ensure accurate calculation of taxes, deductions, and benefits.

03

Human Resources or Payroll Departments: IA salaries are essential for HR or payroll departments to manage employee compensation and maintain accurate records. They use IA salaries to calculate employee benefits, taxes, and deductions accurately.

04

Government Agencies: Various government agencies rely on IA salaries to enforce tax regulations, ensure compliance, and determine the correct amount of taxes owed by employers and employees. These agencies may use IA salaries for audits or investigations.

Fill

form

: Try Risk Free

People Also Ask about

Am I exempt from Iowa withholding?

An exemption is provided for pensions, annuities, self-employed retirement plans, deferred compensation, IRA distributions, and other retirement benefits to qualified individuals. To qualify you must be 55 years of age or older, disabled, or a surviving spouse of an individual who would have qualified.

How do I find out how much I owe the Iowa Department of Revenue?

You have a debt with the Iowa Department of Revenue or other agency. For more information regarding this debt, call 515-281-3114.

How do I pay my Iowa income tax?

Pay all or some of your Iowa income taxes online via: EasyPay Iowa or via ACI Payments. Pay your IA taxes online and you do not have to mail in Form IA 1040V. Complete Form IA 1040V, include a Check or Money Order, and mail both to the address on Form IA 1040V.

What is the wage withholding in Iowa?

If Federal income tax is withheld on a flat rate basis, Iowa income tax must be withheld at the rate of 6 percent. However, if the supplemental payment is included with the regular wage payment, the two are combined and the withholding tables or formulas are used.

How do I pay Iowa income tax?

Pay all or some of your Iowa income taxes online via: EasyPay Iowa or via ACI Payments. Pay your IA taxes online and you do not have to mail in Form IA 1040V. Complete Form IA 1040V, include a Check or Money Order, and mail both to the address on Form IA 1040V.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit office request form online?

With pdfFiller, the editing process is straightforward. Open your office request form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I make edits in office request form without leaving Chrome?

office request form can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out the office request form form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign office request form and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

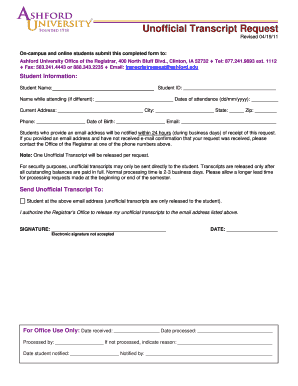

What is Ashford University Official Transcript Request?

The Ashford University Official Transcript Request is a formal process through which students can request copies of their academic transcripts from Ashford University.

Who is required to file Ashford University Official Transcript Request?

Current students, former students, and alumni who wish to obtain their academic transcripts are required to file an Ashford University Official Transcript Request.

How to fill out Ashford University Official Transcript Request?

To fill out the Ashford University Official Transcript Request, individuals must complete the required form with their personal details, specify the type of transcript requested, and provide the recipient's information if applicable.

What is the purpose of Ashford University Official Transcript Request?

The purpose of the Ashford University Official Transcript Request is to provide students and alumni with official documentation of their academic achievements and coursework, which can be used for further education, job applications, or professional licensing.

What information must be reported on Ashford University Official Transcript Request?

The information that must be reported includes the requester's full name, student ID (if applicable), date of birth, contact information, the address where the transcript should be sent, and any specific transcript type required.

Fill out your office request form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Office Request Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.